Paying taxes is certainly one of the basic requirements of every citizen in any country keeping in mind that such contributions are used to drive the economy of the country. This is why you not only have to pay your taxes but you also have to file these returns, of course depending on the laws of the country. Talking of filing tax returns, there is one tax form that comes in mind the IRS Tax Form 1040EZ. Wondering what the Tax Form 1040EZ is all about? Well, this article will tell everything you need to know about the Form 1040EZ including how to use the form.

Part 1 What is the 1040EZ Form

For starters, the Form 1040EZ is simply a short version of the Internal Revenue Service's (IRS) Form 1040. The form is designed to shorten the process of filing cases i.e income taxes keeping in mind that the document only factors in basic tax situations. This means that people with an income tax of not more than $100, 000 are the ones who are eligible to use this form. Additionally one must have an interest income that is not more than $1500 and less or no dependents, to use this form.

Differences between Form 1040EZ and Form 1040

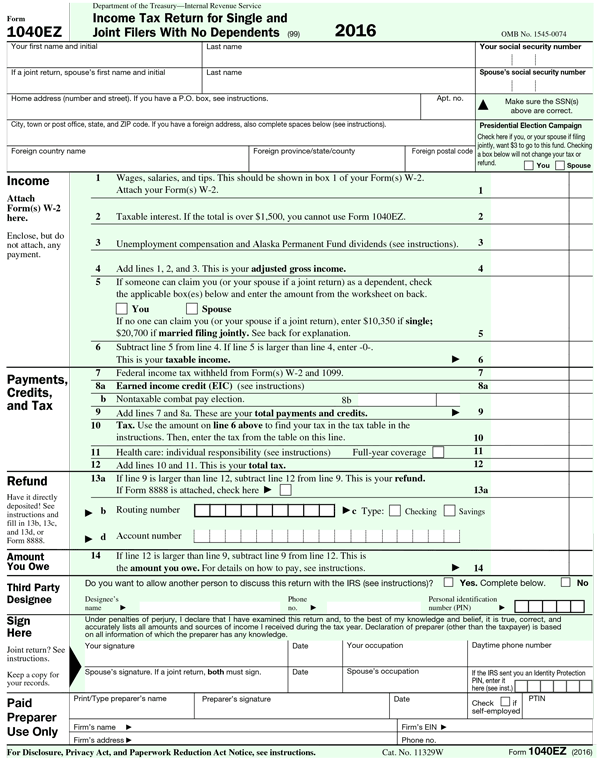

Many people do not really know the differences between Form 1040EZ and Form 1040. The difference is actually in the information captured by the two forms. As a matter of fact, form 1040EZ has 14 lines of information whereas form 1040 has 79 lines of information. Again, this is because Form 1040EZ is designed to capture less information like record wages, salaries and tips, taxable interest under $1,500 and unemployment compensation. So, how do you fill this form?

Part 2 How to Filling Out 1040Z Tax Returns

Step 1: Gather All the Necessary Documents

The first thing you would want to do before filling this form is to ensure that you are eligible to use the form to file your returns. Once you have done so, you can gather all the necessary materials that will aid you in filling the form. We are talking of gathering the W2 form if you are employed. You can then find the PDF version of the form from here.

Step 2: Fill Out the Top Section of the Form

The first place to start filling is at the top of the Form where you will be required to fill in your full name and social security number. These should be the official details as per your Social Security Administration and IRS taxpayer records. This section will also require you to fill in the details of your spouse if available. If you fill in the details of your spouse then it means you are filing "married filing jointly." On the other hand, if you fill in only your name then you will be filing the single option.

Step 3: Fill in the Income Section

The next section captures data in the realm of your income. Here you will be required to fill in your gross wages, salaries and any tips. You will simply need to check your W2 forms to get your details and the total amount that need to be filled in Box 1. You are then supposed to enter any Taxable income in Box 2. Taxable income, in this case, refers to interest you fetch from any accounts you have with other people. If you received any unemployment benefits, you are required to enter the amount in line 3. The next task is to add the details of line 1, 2 and 3 and fill in the resulting figure in line 4. The value is what is known as the Adjusted Gross Income. Line 5 requires that you fill in personal and standard deductions. Once you have filled this line, you can go ahead and subtract the amount in line 5 from the value in line 4 where the amount attained is known as the taxable Income.

Step 4: Complete the Payments, Credits and Tax Section

The first part in this section is the "Federal Income Tax Withheld". You can get this value by checking each of your forms W-2, 1099-INT, 1099-G and 1099-OID, for the values before adding them together and filling this value in line 7 of your Form 1040EZ. You can move on to fill in the Earned Income Credit which is only applicable for those earning below a specified amount of money per year. This value is a tax exemption for people with low to average incomes. The next thing you would want to do is to fill out the total payments and credits by adding the values from lines 7 and 8a then filling in the result in line 9 of the form.

You will then have to fill in the Tax value at line 10-use the value from line 6 and the tax Table to find the right value. This section will be completed by indicating whether you add minimum essential health care.

Step 5: Finish Filing Your returns: Refund/Amount You Owe and Third party Designee

To find if you are due a refund, simply check if the value in 9 is larger than 12. If it is, then enter the amount in 13a. You will also have to fill in your bank details so that the refund can directly be deposited on the account. The same can be said of filling in the amount of taxes you owe; just check if line 12 is greater than 9. If it then enter the value in line 14.

The third party designee section is filled if you want IRS to contact a third party for any queries regarding your returns.

Step 6: Sign the Document

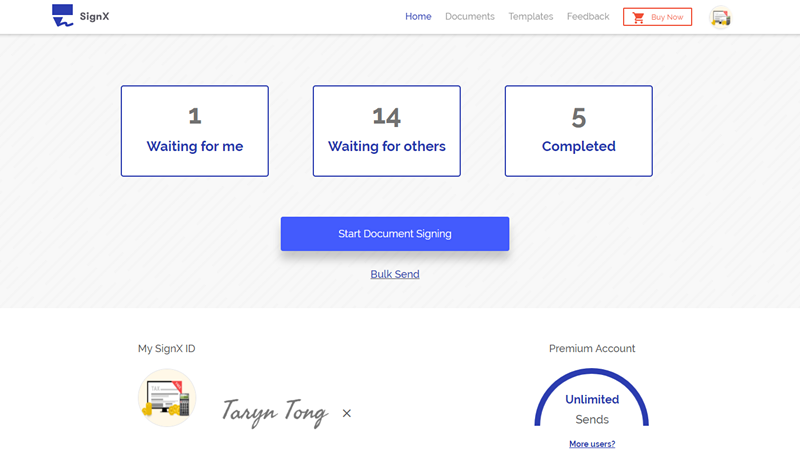

The last step is to make the document legally binding by signing the document. Once this is done, you have now finished filling the 1040EZ form! If you need an electronic signature tool, you can try SignX.

Part 3 Best Tool to Sign with e-Signatures

If you are wondering if you can sign your documents in digital format then you can rest assured that you can do this using e-signature software. One great software that makes this process seamless is SignX. This software can help you sign virtually every type of digital document that includes the PDF format normally used in filing returns digitally.

In other words, you do not have to download the 1040EZ and fill it in handwritten format. You can simply fill it directly and sign it with legally binding e-signatures that is much like wet signatures.