We live in a dynamic world where saving a minute can be precious. Some processes can be hassle-free and much easier to complete. One of those processes is tax filling. Thanks to online tax filling facility, the process of submitting returns is a much more time and effort efficient process. A digital signature allows you to file Tax Returns not just easier, but more secure as well. Tax payers just need to put a digital signature for income tax, and then send the document.

Part 1 The Benefits for Using Digital Signature for Income Tax

Simply put, you need a digital signature to authenticate and validate your identity online. In the same way you need an ID to authenticate, you need a digital signature to prove that the document is yours, and you stand by it. Digital signatures provide high level of security for online transactions, be it sending email, or any other web-based transaction.

A digital signature certificate for income tax will prove ownership of the document. In addition to tax returns, you can use the signature for signing any business document, as well as e-tendering documents and accessing membership based websites. To understand why you need one, we must explain what a digital signature is.

A digital signature is an online equivalent of a handwritten signature or a stamped seal. However, it offers far more and better security. The signature provides not just authenticity of the author, but also origin, status, and identity of an electronic document. In many countries, a digital signature has the same legal significance as the traditional hand-written signature.

Part 2 How to Get Digital Signature Certificate for Income Tax Free

Your digital signature for income tax consists of your name, public key, expiration date of the public key, name of the issuing Certification Authority, serial number assigned to the digital signature, and the digital signature of the issuer. If using online forms, you do not need to send a physical copy of the tax return. Here is the step by step process explained for how to get digital signature certificate for income tax free.

Step 1:

Log into the Income Tax website. If you already have a user, enter your ID and Password. If you do not have a user, sign up for one.

Step 2:

Once you are logged in, click on "My Account". There, select the "update digital certificate". A download will start. You will be warned about a download from an untrustworthy source, and you should click Yes, Accept, or Continue, depending on which browser you use.

Step 3.

The download process will start, and you will receive a file from the Income Tax Department. This file is named "StoreCertificate", and it will store a local copy of the digital signature on your computer.

Step 4.

At this point, you need to go back to the open web page and click "Upload your USB Token". You will be taken to a page where you should click on "Select your USB Token Certificate" and Brose". Once you click the button, a selection window will open.

Step 5.

Find the select the file you downloaded in the selection window. Usually, the file can be found in this path C:\WINDOWS\system32\eTPKCS11.dll. Select the file, and click "Okay". Next, you need to enter the PIN code and click on "Sign". This will help you create a digital signature with the department of Income Tax.

Part 3 How to Submit Income Tax

You can use the digital signature you created to upload income tax online. Here is a breakdown of that process.

Step 1:

Open the income tax return form, fill it out properly, and then generate the file as an *xml file. Save the file on your local computer system.

Step 2:

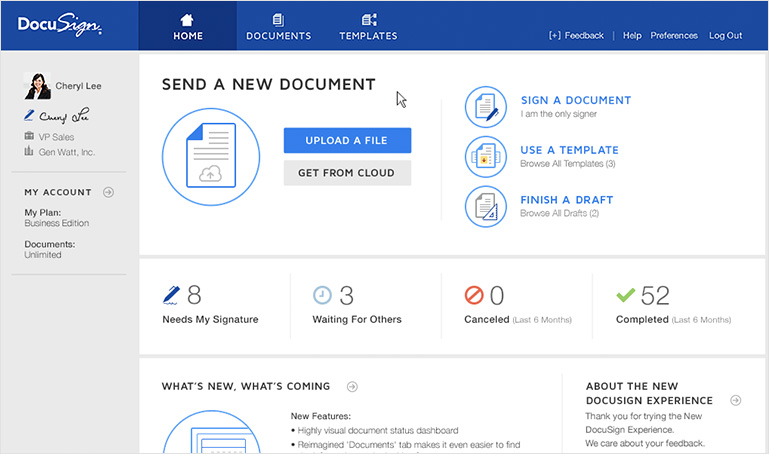

Open the login page for Income Tax, and then enter your credentials to log into the tax management dashboard.

Step 3.

Find the tab "Submit Return" and then select the "assessment year". Select the form name from the drop down menu.

Step 4.

You will be asked "Do you want to digitally sign the file", on which you should click "Yes".

Step 5.

You will be asked to choose the type of digital signature. Click "Sign with USB Token". Upload the Income Tax Return with your digital signature certificate. Authenticate, and that is it.