Most of us are accustomed the Form W-2 but less so with what is known as the IRS Form 1095. Well, you may find this form in your mail box and you may be stay stuck trying to decipher what the form is all about. If you are in this boat then you need not worry as this article is going to expound more on the content of the Form 1095 in a bid to make you understand this form better.

Part 1 Overview Introduction to Form 1095 (ABC)

For starters, the form 1095 is a series of documents that are used to file healthcare insurance coverage as per the regulations described in the Affordable Care Act. Basically, each type of the Form 1095 states the primary recipient of the insurance policy act whilst also indicating all the individuals covered under the recipient. The forms also stipulates the time the insurance policy covers in terms of months or years. The Form 1095 series is made of three types of forms i. e the Form 1095-A, 1095-B, 1095-C. Let's dig deeper.

The Form 1095-A: Marketplace Insurance Statement

The Form 1095-A is also known as the Marketplace Insurance Statement and it is a form issued by state and federal marketplaces to those people who had marketplace coverage in the year. It is a must have form for those were allotted advanced premium advanced tax credits to aid them to pay health insurance coverage in the year. The information filled in this form will then help in the reconciliation of premium tax credit.

The Form 1095-B: Health Coverage

This is a detailed form is used to fetch all information that is not captured by the Form 1095-A and the Form 1095-C. In other words, the form captures policies that are provided by health insurance providers like Medicaid, CHIP, Medicare Part A, TRICARE, VA, etc. This form is normally not needed when one is filing for tax returns given that most users will know about the insurance coverage status of the household-even without the Form 1095B. If this form is not mailed to you on time and you are not sure of the coverage status of your household, then you can simply call your insurance service provider and you are good to go.

The Form 1095-C: Employer-Provided Health Insurance Offer and Coverage

This form is filled to report health insurance covered by large employers or rather, the form is used by big employers that are mandated to offer insurance to its employees or face penalties if they don't. This form is filled by the employer to indicate info on the insurance coverage it offered employees and whether the employees reciprocated by taking advantage of the coverage. It also indicates if the employee is self-insured or not. In the case that the employer uses another health insurance other than the self-funded plan, then the employee may get the Form 1095-B and the Form 1095-C separately. The former will be sent by the health insurance company while the latter will be sent to the employees by the employer.

Part 2 Amended Return Relief for 1095-B and 1095-C Users

Again, you can file your tax returns without the Form 1095-B and the Form 1095-C but you should strive to give out as your insurance coverage status in the most accurate way you can. You can do so by getting clarification from other sources such as your employer or your insurance service provider.

So, what will happen to you in case you make a mistake when providing this information? Well, the IRS has ensured that you are not penalized as long as you were mailed the two forms later than they are supposed to. This is to say that you will not need to amend your tax returns if you receive Form 1095-B and Form 1095-C that doesn't match with what you had reported. You just need to ensure that you escalate any inaccuracies to IRS for the purposes of correction.

Part 3 How Do You Sign Your Documents Electronically

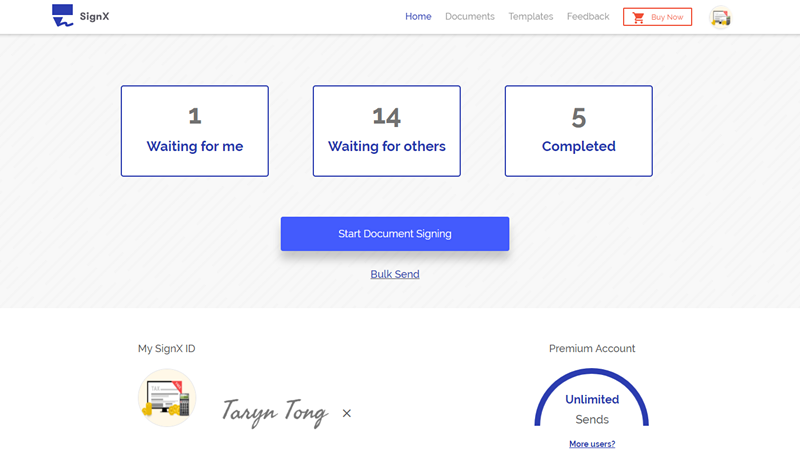

The question of signing tax documents is also a topic that crops up whenever taxpayers want to file their tax returns. This owed to the fact that many taxpayers may be interested in filing the documents in electronic formats. In the business world, signatories may also want to sign and send the documents to others for signing. If you are caught in such a scenario then you may want to try out e-signature options.

This is just jargon for signatures done electronically using certain software. There are lots of software but you will certainly want to use a software that has a track record for delivering quality e-signatures, simulating the traditional ways of signing documents. Talking of quality software, there is one known as SignX that you may want to try. As a matter of fact, SignX is a software that not only allows you to sign documents electronically but also allows you to send them to others to sign them. What's even cooler is that you can track the documents and get alerts whenever they are opened and signed, a feat that will enable you send notifcations to other signatories in case of delay. Isn't this very good for business?

Long story short, it's always vital that you know some of the most common Tax forms by the IRS so that you can stay on top of your tax obligations and plans. Moreover, you can inculate tools like SignX that can help you handle tax forms in an efficient way hence making the process of dealing with such documents seamless.