Virtually everything these days can be done online in any place anytime and anywhere, from the comfort of your computer! This includes even vital tasks like the filing tax returns, in what has come to be known as e-filing of income tax. Well, e filing income tax returns is more of a necessity than a choice for any citizen and this is why you should always be aware of some of the most efficient ways to do this. How do you file your taxes online? Well, this article will take you through some of the easy places to file income tax online. So, read on and take some notes!

Part 1 Top 5 Ways to e Filing Income Tax

1. Official IRS.GOV

One of the first places to look when you want to file your income tax online is the IRS website for a service known as IRS Free File. This is actually a partnership between IRS and Free File, which is a group of private-sector tax software companies that make their software open source.

The beauty with this option is that you will be using the free feature for the purpose of creating e-files then submitting them. It can also help you discover tax breaks that you may be entitled to. What’s even cooler is that if you can’t file your taxes on time, then you are given the chance to ask for an extension via Free File.

2. TurboTax

TurboTax is one of the most popular tax preparation tools in the US and it’s not by a fluke. Developed by Michael Chipman in the 80s, this software has grown into one on demand tax software covering everything from federal and state income tax returns.

This software has a very intuitive user interface crafted to guide even the novice in preparing tax returns. It gets even better as the TurboTax software goes as far as offering additional support to users by offering what is known as the Audit defense from TaxResources.inc.

The only downside of TurboTax is the fact that it is a bit expensive but certainly worth the investment. Besides, users can still take advantage of the free e-filing income tax options such as filing Form 1040A or 1040EZ.

3. TaxSlayer

Looking to e filing income tax and prepare tax on a budget? If you are then TaxSlayer is a premium but very affordable software to look at. The software joined the fray as a tool to aid accountants and tax experts in preparing taxes but it switched to an individual tax preparation option in the 90s.

One of the pros of TaxSlayer is the fact that it supports some common IRS forms such as the W-2 forms. In other words, it allows you to import the W-2 forms from payroll service providers. TaxSlayer’s pricing is structured in three categories depending on the needs of the clients. Like the Turbo Tax, the free package is designed for users who want to file the Form 1040A or 1040EZ. The classic package adds support of common IRS forms while the Premium package adds extended support into the classic features.

4. Jackson Hewitt

Jackson Hewitt might be one of the youngest platforms in this list but it is definitely one of the best places for free e-filing income taxes online. The online tax software is very easy to use keeping in mind that it is built on a simple conversational language that is very simple for users to understand.

As a matter of fact, the tool uses a wizard that guides you through everything in the realm of income and deductions whilst also guiding you through the relevant documents you will need. The free e-filing option in the case of Jackson and Hewitt package covers W-2, interest, and unemployment income.

5. Credit Karma Tax

This software is only the last on the list by the virtue of the fact that it is relatively very new having been launched in the year 2016. That said, it has exceeded the expectations of many as the only online free tax preparation software that supports all major IRS forms and schedules. Yes, that’s right! You can do free e-filing of income taxes with this software.

The only downside though is that you will not be able to import from competitors but still everything done of the software is free!

Part 2 The Best Tool to Sign Documents

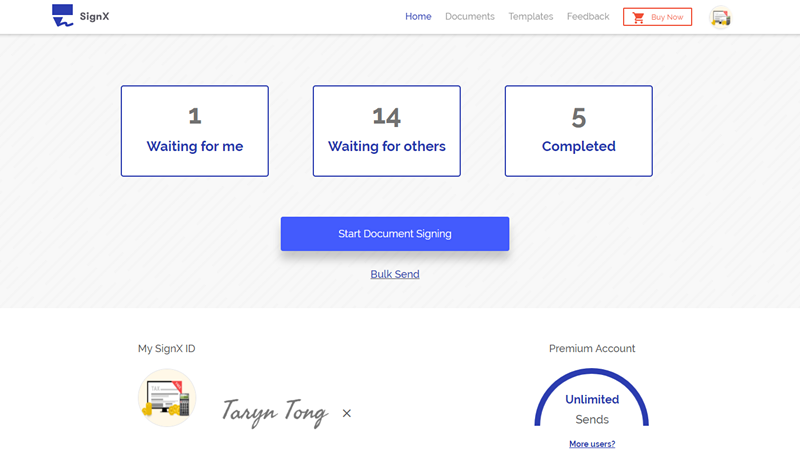

Now that you know how to e-file tax returns online for free, the other question you may be asking is “how do you sign your documents, digitally?” well, you can simply use an e-signature software to help you create wet like, legally binding signatures in any of your tax documents. One such tool is SignX, a service that will let you sign and even send your tax documents for e-signing by any relevant parties.

SignX is actually great for businesses that not only want swift processing of tax documents, but also want to go paperless for all works. It helps closing deals quickly and seurely. Why not have a try?