Most people do not really get the jargon used in the world of Taxes. Talk of things like the 1040, the 1099 or the W-2 forms. If you do not really have a grasp of these IRS forms, then you are not alone as most people get lost when it comes to differentiating the forms used by IRS-even professionals! The IRS, in this case, refers to the Internal Service Revenue of the US. We have done the chewing for you and in this article we will highlight some of the most common IRS forms you should know. So, just read on and swallow!

Part 1 Top 10 Types of IRS Forms

Top 1 IRS Form: 1040

The simplest of all the tax forms you will ever encounter is the Form 1040. It is where most tax payers start out. This form is usually used by those who want to itemize their deductions, or things like file income from a sale or property, or filing income from self-employment.

Top 2 IRS Form: 1040EZ

This form is similar to the Form 1040 albeit with a bit of tweaks to cater for individuals who are married or single but with no dependents. In this regards, the form has made things quite simple and short, with just six sections. No wonder, it falls under the category of easy forms. This form has been in use since 1982 and it is targeted at those who earn less than $100, 000. Your interest income should also be somewhere less than or equal to $1500 for you to use this form.

Top 3 IRS Form: 1040A

This form is somewhere in the middle of the Form 1040 and the Form 1040EZ. In other words, you can use the form if your income is $100,000 or less just like the Form 1040EZ. On the other hand, it has fewer tax deductions and tax credit options when compared to the Form 1040.

Top 4 IRS Form: W-2

If you are a salaried employee then this form should be a familiar thing to you. It is also known as the Wage and Tax Statement-it is used to report all the wages paid to employees coupled with all the taxes withheld to the employees. The form must be filled and sent to the employees by employers who they have agreed to pay salary and other compensation. The form is then used by the employee to prepare their income tax returns before the deadline set by IRS.

Top 5 IRS Form: W-4

The Form W-4 is a form used by employers to determine the amount of tax to deduct from their employees. In most cases, the tax withholdings should be equivalent to the annual tax due as per form 1040. That said, deductions may be done based on employee input hence a scenario where there is an amount due or payout at the time of filing income tax returns.

Top 6 IRS Form: W-9

This form has two main roles. First, the form can be leveraged by third parties to collect identity information when filing returns with the IRS. For this reason, the form seeks to pick the name of the user and the taxpayer identification number. The other function of this form is to aid the payee in avoiding backup withholding. In other words, every tax payer is supposed to collect withholding taxes on certain payments from the IRS.

Top 7 IRS Form: 1099-MISC

This Form is popular among the ever escalating number of freelancers in the US. It is used to report information on reception of payments of $600 or more in a given year. The MISC stands for miscellaneous income thus the document can also apply if you made direct sales of $5000 or less.

Top 8 IRS Form: 1098

If you are a homeowner who is currently paying a mortgage whilst also renting it out, then you should know of Mortgage Interest Statement. This form comes in handy for those who receive $600 or more in the realm of mortgage interest. The interest, in this case, can be tax deductible as an itemized deduction.

Top 9 IRS Form: 1099 Series

This series of forms are used to report any other type of income other than salaries, wages, tips etc. A very good example of its use us a scenario where is a transaction with say, independent contractors for their services.

Top 10 IRS Form: 8962

This is a form that is used to report advanced premium tax credit that is accrued through the Affordable Care Act coverage. This form is used to calculate the tax credit you might get depending on if you qualify for Premium tax credit.

Part 2 Signing Your Documents in Digital Formats

It's not just enough to know about tax documents that are popular around the US, you also need to know how to make your e-filing seamless. One way to certainly do so is to e-signatures to sign your tax documents. How do you do this? It's simple! You just need an e-signature software that can create wet- like signatures.

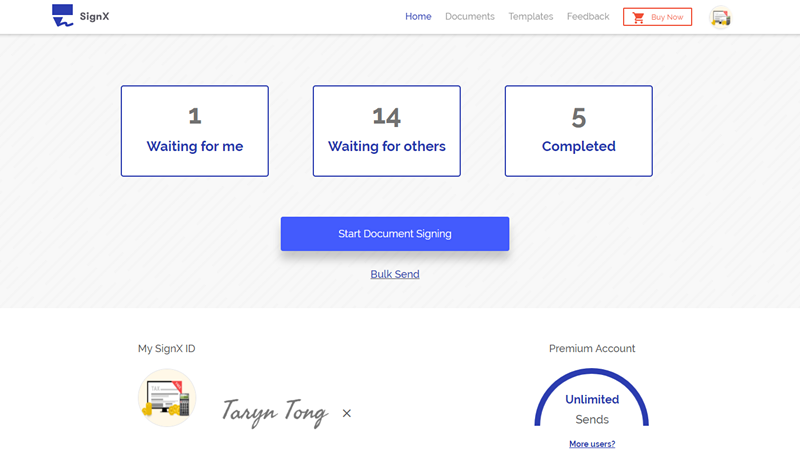

The beauty is that there are many software in the market to deliver such e-signature services but SignX has got to be the one that is worth a mention. The software is affordable and crafted for both individuals and business. As a matter of fact, the tool will help you create legally binding e-signatures in any of your tax documents in just the same way you would do with a pen and a paper.

Perhaps a fascinating aspect of this tool is the ability to send and track your tax documents as-you can send documents for signatures from other relevant parties. This has been made possible through an easy to use dashboard where you can go as far as sending tailored reminders to signatories hence ensuring that your business processes are running like a well-oiled machine. It also supports multiple users to share a single SignX account.

The bottom line is that you should always ensure that you are on top of your tax affairs whilst also ensuring that these affairs never peg back your business processes. So, you should always know which tax forms are relevant to you and your business.