Ever wanted to estimate your tax returns or rather find how much you owe or how much refund you are owed? Well, there are lots of great tax return estimators online you can use to help you prepare your tax returns and subsequently stay ahead of time in terms of planning. Talking of Tax estimators there are some many good ones online but in this article, we will look at 5 that stand a cut above the rest. In other words, we will be looking at the most accurate ones and those that are easy to use.

Part 1 5 of the Best Tax Return Estimators

1. SmartAsset Federal Tax Calculator

This income tax calculator is simple but very effective in delivering accurate federal tax estimates. The income tax calculator is structured in two formats the simple one and the advanced option. In the former, the tax calculator will let you enter household income, and you filing status while in the advanced option you will include 401(k) Contribution, IRA Contribution, itemized Deductions and the number of personal exemptions. If you are retired then there is a Retirement Income Tax Calculator.

The SmartAsset Federal Tax Calculator is thus one tax return estimator you can take advantage of when looking to estimate your taxes swiftly without having to spend lots of money hiring third parties to help you handle your tax business.

2. TurboTax Taxcaster

TurboTax is an online software needs no introduction in the world of software having been in the game for decades now. Did you know that they also have a free tax calculator? The calculator is surely tax refund estimator and tax returns estimator that is certainly worth trying. The beauty is that TurboTax has the tax return estimator in android and IOS thus you can use the estimators on android.

Turbo Tax Refund Calculator has also made it easy for those looking to file taxes for the first time thanks to features like a document checklist. This is also quite good for those who may have experienced changes over the past year that affects the way they have been filing their taxes. On top of that, students and dependents have been afforded their own tailored tools in this platform. Thanks to this features, it is no surprise that this software is top on this list.

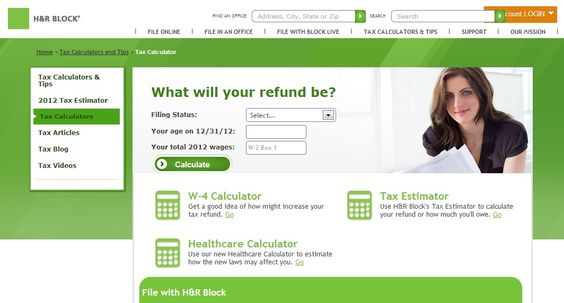

3. H&R Block Tax Estimator

H&R Block Tax estimator is one of the big boys when one thinks of Tax calculation services. One of the fascinating aspects of the H&R Block Tax estimator is the simple, intuitive UI that makes it easy to calculate the amount the IRS will refund you or conversely, how much you will have to pay the government. The tax return estimator is perfect for handling simple tax calculation but it is also pretty useful in W-4's and estimating how the Affordable Care Act will impact on your refunds. The web platform also offers as a Spanish version just in case you are more comfortable checking your tax estimates in Spanish.

4. eSmart Paycheck

If you feel safer being logged into a system before calculating your taxes then eSmart Paycheck is the tool for you. In fact, this is the only tool in this list that requires you to log in before doing your tax estimates. In essence, eSmartPaycheck is a payroll software management software that can help users calculate federal and state taxes. The software has a very easy to use free tax calculator by entering vital information exemptions and hourly rates.

5. TaxAct Tax Calculator

This is yet another simple but very effective tax return estimator you can leverage to estimate how much you owe and how much tax refund to expect. With this income tax estimator, you will be able to inculcate things like deductions, income, and tax credits like energy saving and education.

Part 2 The Tool to eSign Your Tax Documents

You might be interested in filling your documents digitally but the real hurdle is how will you sign these digitally? Well, there are great tools you can use to create legally binding e-signatures. One of the best tools to do this is SignX, a tool that lets you create e-signatures that are similar to handwritten signatures.

SignX is actually super easy to use and it makes the process of creating, sending and tracking the signing of documents, very easy. This will make the process of signing any tax documents in a business fast and subsequently make your business super-efficient. Now it is time to use these tools to smoothen the process of planning for your future. After all, these tools are free.